BEST HOME FUNDING SOLUTIONS

Solving Investment Challenges: Understanding Your Deals, Providing the Funds

$1,000

Closing Cost Credit Back to You

FREE

Consultation & Property Assesment

$500

Referral incentive

on closed deals

FUNDING OPTIONS

We help investors fund non-owner occupied investment properties whether a short term Fix & Flip or a long term investment.

Funding Investments, Building Dreams

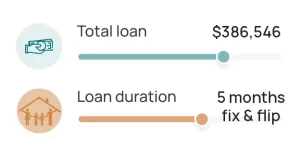

Short Term Purchase & Rehab Loans

We can fund up to 100% of your non-owner occupied single family properties for a fix & flip or fix to rent for one to twelve months.

Short Term Key Features

What are the optimum requirements, however if your project is “out of this box,” we still have options for you.

- Residential Non-Owner Occupied

- House size maximum 2,800 square feet

- Lot size no bigger than .5 acres

- Sales Price does not exceed FHA maximum

- Maximim 5 bedroom/3bath

Long Term Investment Loans

We are the right lending partner to help you scale your rental property portfolio. Approval is based on the property cashflow – not your tax returns. Although experience is rewarded, is NOT required.

Long Term Loan Key Features

Rental Loans for non-owner occupied with attractive rates starting at 7.5%. Up to 80% LTV purchase and Refinances and up to 75% LTV Cash-outs.

Commercial Investment Loans

We offer a flexible, small commercial solution for today’s real estate investing in Self Storage, Apartment Complexes, Multi-family, Mixed use and more.

Commercial Loans Key Features

- Loan amounts up to 5MM

- Up to 75% LTV

- First-time investors are welcome

- Based on property value, not personal income

- Great for qualifying self-employed investors and small business owners

OUR APPROACH

Understand Your Needs - Crafting Solutions

We help you evaluate the property and ensure that your investment is protected.

Easy application process

Flexible repayment options

Competitive interest rates

THE FUNDING PROCESS

Take control of your financial future with our tailored loan solutions

Our quick and easy application process, competitive rates, and flexible terms make it easy to get the money you need to get to the closing table.

Our process to approve your loan proceeds at your speed.

We provide a Proof of Funds Letter to help you get the property under contract. Next, we appraise the property and evaluate the value before and after necessary repairs. The value of the home helps secure the loan, so we help you look at every aspect of the solution to minimize your risk. As you submit your loan documents, our power team will process the title report to protect your investment and prepare for the closing.

Secure and confidential

Helpful and friendly customer service

No hidden fees

Competitive interest rates

Flexible repayment options

Easy application process

Private Money Funding for Real Estate Investments

If you have a self-directed IRA, we can partner with you to begin investing in non-owner occupied properties. Our power team can manage the property and send a monthly check to your IRA account.

Eric Taylor

I had a great experience with getting the loan I needed. The interest rate was great considering I only needed the loan for three months.

Martin Schumacher

Thanks to Best Homes Funding, I was able to purchase an investment home that I now manage through my self-directed IRA.

Alvin & Patty Wilson

As we got married we had a decent down payment, but our credit wasn't so hot. We got in on a Lease Option and are making consistent payments to build up our credit.

FAQS

Frequently asked questions

We offer short-term, long-term and commercial loans for the investors looking to start or expand their portfolios. With our comprehensive loan offerings, we strive to provide a solution for every unique investing situation.

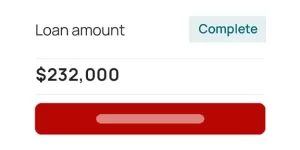

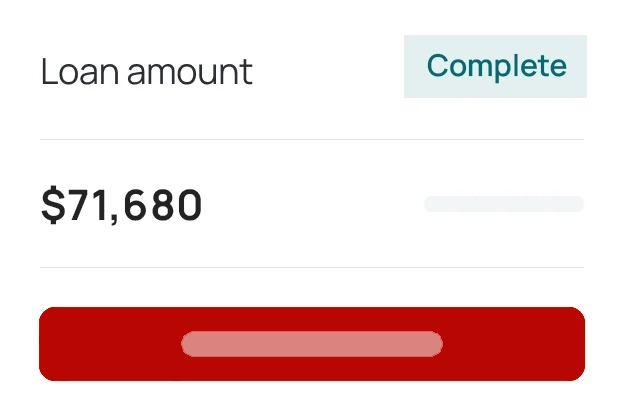

Our loan offerings are flexible and tailored to your unique circumstances. While the amount you can borrow depends largely on the value of the property and the borrower’s down payment, we typically loan up to 70% of the After Repair Value (ARV). However, we understand that each deal is unique, and we don’t want you to miss out on a great opportunity. Therefore, we might partner with a Rehabber in a joint venture in certain instances, providing nearly 100% of the short-term financing required. It’s crucial to note that while demonstrating the ability to make payments is important, the value of the real estate asset is what primarily secures the loan. Our commitment is to provide you with personalized, flexible solutions, be it short-term or long-term loans, or Rent-to-Own and Lease Option plans, aimed at empowering you to make confident real estate decisions.

The loan application process with us is streamlined and efficient. We evaluate factors such as the property’s appraised value, the borrower’s experience, equity or merit of the property, and a feasible exit strategy. If you’ve closed a loan with us before, the process can be even quicker, potentially closing your next deal within a week. Ultimately, the speed of loan closing often mirrors the pace at which the borrower can submit necessary paperwork and forms. Our loans require significantly less paperwork than traditional institutional loans, enabling us to typically close loans in under three weeks. Remember, the faster the necessary documents are provided, the quicker we can commence the underwriting process and get you the funding you need.

The interest rate on our loans is determined by a variety of factors tailored to each unique scenario. Key determinants include the appraised value of the property, the equity created through your down payment, and the value of any other real estate investments you own. We take all of these factors into account to provide a comprehensive loan solution that’s suited to your specific financial circumstances, ensuring our rates remain as competitive and fair as possible.

Most of our loans are secured using the property being purchased as the collateral. This means that the property itself serves as the security for the loan. In situations such as Rent-to-Own opportunities, the collateral, which is the property, remains with the lender until all conditions of the lease option agreement are fulfilled. This approach ensures the protection of both parties and allows us to provide flexible and effective real estate funding solutions to meet your unique needs.

As a private money lender, we take a more holistic approach to assessing loan applications. While credit score is a consideration, we place greater emphasis on other factors such as the appraised value of the property, its equity, and your experience as a borrower. We understand that circumstances can lead to declined bank loans, whether due to credit issues or excessive loan conditions. That’s why we strive to offer flexible and inclusive loan solutions, ensuring that a wider range of borrowers can access the funding they need to realize their real estate goals.